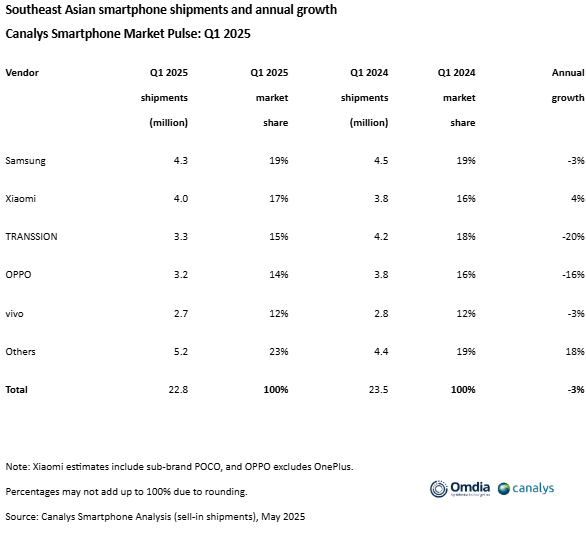

Southeast Asia’s smartphone market declined 3% in early 2025 due to high inventory levels from late 2024 and weakened consumer demand, especially in low- to mid-range segments. Rising average selling prices, driven by inflation and high-end launches, are expected to continue increasing.

Vendors are adapting by diversifying channels and adjusting portfolios. Xiaomi rose to second place by launching new models early and expanding D2C and telco partnerships. HONOR saw 88% growth by targeting varied price segments, while Samsung grew its 5G A-series by 47%, focusing on value and telco ties.

Regional instability and global tensions are pressuring the market, but countries like Vietnam are gaining importance in production due to their infrastructure and 5G potential. Malaysia, Indonesia, and Thailand are also strengthening their roles in the smartphone supply chain.

Source: Canalys